german tax calculator berlin

65 - Brandenburg North Rhine-Westphalia Saarland Schleswig-Holstein Thuringia. Property transfer tax rates in Germany are as follows.

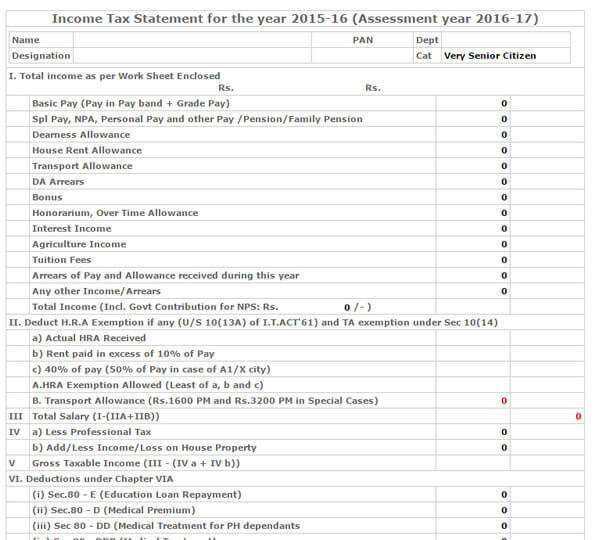

Tax Calculator With Pension Flash Sales 58 Off Www Quadrantkindercentra Nl

If you only have income as self employed from a trade or from a rental property you will get a more accurate result by.

. You are living in Berlin the capital of Germany. Up to 19 968. Germany is not considered expensive compared to other European countries the prices of food and housing.

Our operators speak English Czech and Slovak. Ad Easy tax return tool for foreigners and expats in Germany 100 in English. It will naturally be the biggest deduction and is mandatory for anyone earning over 9000 a year.

1881 2005. 115 836 549 226. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll.

How much of my salary actually ends up in my account. United States Sales Tax. I II III IV V VI.

As of 1 January 2021 the application of the solidarity surcharge tax has been substantially reduced. For this example I assume that you also have to pay church tax have no children and you have health pension and unemployment insurance. Calculate here quickly easily and for free how much net remains of your gross salary.

Most of our properties are situated. Please note that this application is only a simplistic tool. Income tax bracket 2022 married couple Tax rate.

35 - Bavaria Saxony. For assistance in other languages contact us via e-mail infoneotaxeu. Germans are notably known to be unwilling to invest into stone or land.

However please keep in mind no calculator is 100 accurate. Other possible external factors may have an effect. A lower property tax means a higher yield lower cost on your investment.

Calculate United States Sales Tax. 19 968 115 836. There is base sales tax by most of the states.

German Mortgage Repayment Calculator. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag. Capturing income portions exceeding EUR 274613 for a single-filing individidual is 45 but for capital income see 4.

Usually within 24 hours. Just ring us through and we will call you back as soon as possible. Enter your gross income for the chosen period monthly or yearly Monthly Yearly.

It is a progressive tax ranging from 14 to 42. Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of any double taxation treaties signed with your country of residence. In Berlin for example only 15 of local residents own their flats.

You need to fill in two fields. This is where the income tax system comes into play. 420 234 261 904.

To be able to calculate property tax in Berlin certain criteria rules have to be considered. Ad Easy tax return tool for foreigners and expats in Germany 100 in English. Do not fill in the currency.

For a final view on German taxes we kindly ask you to. The income tax gets deducted from your monthly salary by your employer. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of 90000.

In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis. Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany. The calculator covers the new tax rates 2022.

The SteuerGo Gross Net Calculator lets you determine your net income. Income tax payable on your salary. 60 - Berlin Hessen.

Financial Facts About Germany. You can enter the gross wage as an annual or monthly figure. From 58597 117194 all the way to 277825 555650 taxed at a flat rate of 42.

Tax rates are calculated on progressive rates starting at 14 and rising to 42 or 45 for very high incomes. The German Annual Income Tax Calculator for the 2022 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax you will pay in 202223 and your net pay the amount of money you take home after deductions. Annual gross income 34000.

Sales Tax in US varies by location. As an expat living and working in Germany you are qualified to do your tax return. These figures place Germany on the 12th place in the list of European countries by average wage.

This mortgage calculator gives you a quick overview of your real estate financing in Germany. 16 19 5 7. It depends on your personal situation and which Tax Class you fall into which is explained.

As an expat living and working in Germany you are qualified to do your tax return. Get in touch with us. 50 - Baden-Württemberg Bremen Mecklenburg-Vorpommern Niedersachsen Rheinland-Pfalz Saxony-Anhalt.

Calculate your Gross Net Wage - German Wage Tax Calculator. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. This German salary calculator is designed to give you a pretty good estimate of how much you can expect to take home after taxes and social contributions based on your tax class and other factors.

About this German salary calculator. How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany. From 9985 19970 to 58596 117192 taxed at a rate of between 14 to 42.

The calculator will produce a full income tax. Income more than 58597 euros gets taxed with the highest income tax rate of 42. A minimum base salary for Software Developers DevOps QA and other tech professionals in Germany starts at 40000 per year.

Calculating property tax in Berlin. This is how married couples registered partners are taxed in Germany if they do a joint tax declaration. The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month.

Finally a rich tax rate for income portions exceeding EUR 274613 double that for married couples at a rate of 45 applies. In other words the top income tax rate in Germany in 2021. For both instances I will assume a monthly gross salary of 3500 Euros in the accounting year 2022 the tax class 3.

German Tax Calculator Easily Work Out Your Net Salary Youtube

Tax Calculator With Pension Flash Sales 58 Off Www Quadrantkindercentra Nl

Tax On Pension Calculator Shop 57 Off Blountpartnership Com

Salary Calculator Germany This Is How Much Net Income You Will Earn Sib

Tax Calculator With Pension Flash Sales 58 Off Www Quadrantkindercentra Nl

Tax Calculator With Pension Flash Sales 58 Off Www Quadrantkindercentra Nl

Amazing Series Of Still Life Photos By Berlin Based Creatives Eva Jauss And Michael Breyer The German Austrian Duo Creative Photography Grid Design Creative

Tax Calculator With Pension Flash Sales 58 Off Www Quadrantkindercentra Nl

German Wage Tax Calculator Expat Tax

Tax Calculator With Pension Flash Sales 58 Off Www Quadrantkindercentra Nl

Income Tax In Germany For Expat Employees Expatica

German Annual Salary Calculator 2021 22

German Income Tax Calculator Expat Tax